Google (Alphabet) Stock Outlook for May 8, 2025

Estimated reading time: 7 minutes

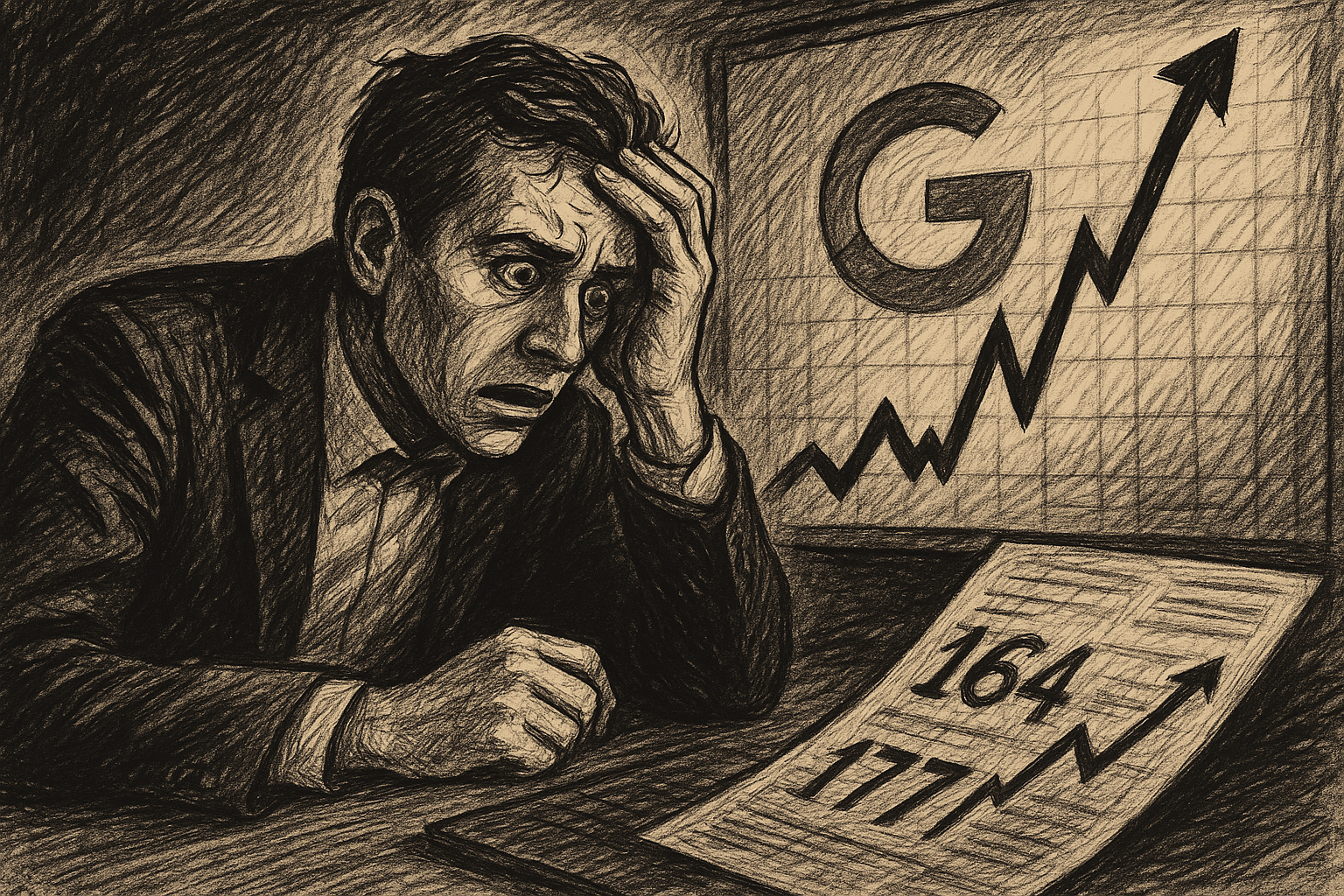

- Short-term caution, long-term optimism: Expect limited volatility around $164–$165 with a ceiling of $177.

- Market “fear” creates windows for value: Bearish sentiment may produce brief buying opportunities.

- Technical momentum is mixed: Trading below the 200-day moving average invites potential value seekers.

- Sector resilience stands out: Alphabet leads returns versus peers amid ongoing tech challenges.

- No imminent catalysts: Expect consolidation or gradual appreciation in the absence of major news.

Table of Contents

- Industry Trends & Background

- Big Tech Performance Context

- Technological Shifts and Economic Forces

- Insights from Recent Research

- Market Sentiment & Analyst Perspectives

- Practical Takeaways

- How Investors Can Use This

- Connecting the Topic to AI Consulting & n8n

- Final Thoughts

- FAQ

Industry Trends & Background

Alphabet Inc. (GOOGL/GOOG) has made significant strides in the tech sector, navigating through shifts in digital advertising. As we draw closer to May 8, 2025, the stock remains a focal point for many.

Big Tech Performance Context

In Q1 2025, Alphabet reported revenue of $76.5 billion, exceeding expectations, leading to notable share price increases. This robust performance showcases Alphabet’s hold on the market, positioning it strongly against its tech peers.

Technological Shifts and Economic Forces

The digital advertising landscape has transformed due to privacy concerns and AI advancements. Alphabet strategically employs machine learning to enhance their ad relevance, maintaining its competitive edge.

Insights from Recent Research

Short-Term Price Forecasts

As of May 8, 2025, predictions estimate Google’s stock price near $164.35 per share. Analysts foresee an intraday range of $151.20 to $177.50.

Technical Indicators and Investor Mood

- Current Price: ~$165

- 50-Day SMA: ~$161.52

- 200-Day SMA: ~$171.56

- RSI (14-day): ~46.7 (neutral to mildly bearish)

- Fear & Greed Index: 39 (market indicates “Fear”)

Market Sentiment & Analyst Perspectives

Despite a cautious market sentiment with a Fear & Greed Index of 39, experts suggest potential value in GOOGL stocks, anticipating gains as market conditions stabilize.

Practical Takeaways

- Expect limited price changes around $164–$165.

- Watch for buying opportunities in bearish conditions.

- Observe technical indicators for potential entry points.

- Recognize Alphabet’s position within the tech sector amidst volatility.

- Stay informed to leverage steady returns.

How Investors Can Use This

Investors should evaluate their risk profile and consider steady accumulation strategies in the current market environment, leveraging opportunities as they arise.

Connecting the Topic to AI Consulting & n8n

The success of Alphabet highlights the importance of AI and automation in driving business value. Companies are encouraged to adopt such technologies through solutions like n8n to enhance operational efficiency.

Final Thoughts

As May 8, 2025 nears, investors should focus on strategic positions while monitoring market conditions that could affect Alphabet’s growth trajectory.

FAQ

What is the expected price of Google stock on May 8, 2025?

The expected price is approximately $164.35 per share.

What are the main drivers of Alphabet’s stock performance?

Key drivers include dominance in search advertising, cloud growth, and AI advancements.

How does the Fear & Greed Index affect investor sentiment?

A lower index indicates fear, which can present buying opportunities for value investors.

What should investors watch for in Alphabet stock?

Investors should monitor technical indicators, earnings reports, and broader market conditions.

Where can I find more information on Alphabet stock?

Coincodex GOOGL Price Predictions provides detailed insights.